The Big Question: Which Business Entity Should I Choose?

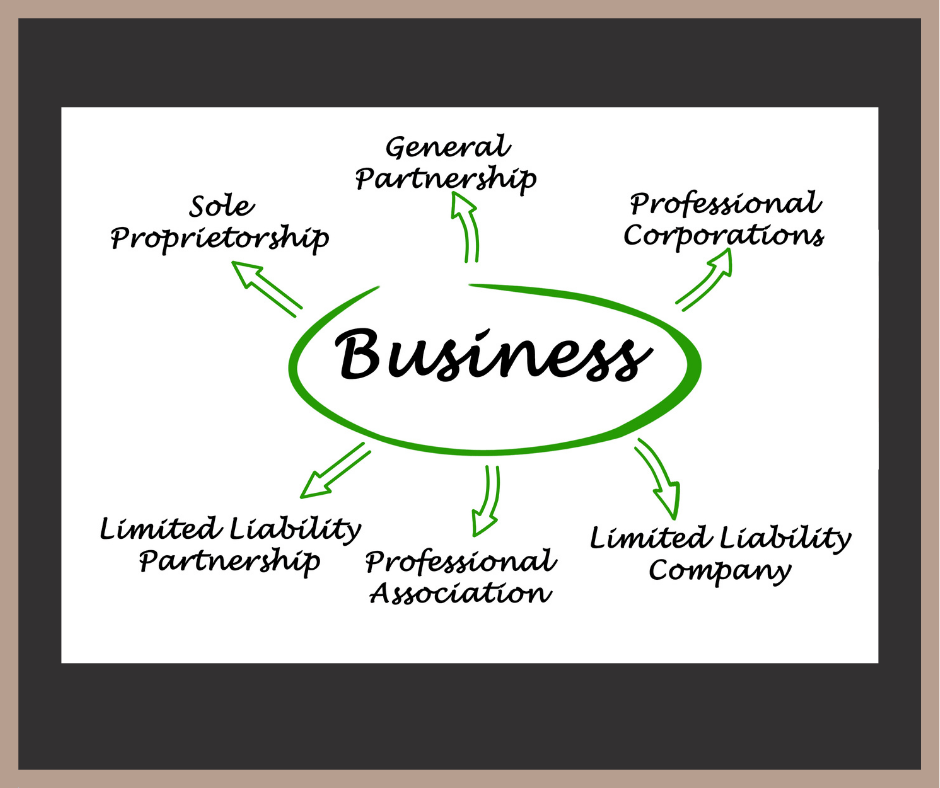

Choosing a business structure is one of the first steps you’ll take in forming your business. Unfortunately, doing so can be difficult because there are so many options.

Choosing the “right” option will depend on the needs of your particular business. That said, there are key differences between the most common business entity types that can help you narrow your choices.

The Most Common Types of Business Entities

Each business entity type has strengths and weaknesses. Some best suit small businesses while others favor larger enterprises.

Sole Proprietorships

A sole proprietorship is the simplest business entity. If a business never files paperwork to become another entity type, the law automatically classifies the business as a sole proprietorship.

As a result, this type of entity is highly flexible and gives you total control over your business. A word of warning, though: because there is no separate business entity, you are personally responsible for the assets and liabilities of the business.

Limited Liability Companies (LLCs)

An LLC provides the protection of a legal business entity without some of the complications that come from forming a corporation. LLCs generally work best for small or medium-sized businesses, and offer a lot of flexibility when it comes to management.

Additionally, LLCs can be quite flexible when it comes to taxes. Because they have no specific tax classification, many LLCs take advantage of pass-through taxation through S election with the IRS.

Corporations

Corporations also offer a legal structure that will shield you from personal liability for your business’s debts. Unlike LLCs, however, corporations must adhere to a fairly rigid management structure and recordkeeping requirements. However, corporations have more robust options when it comes to obtaining capital from investors.

By default, the IRS taxes corporations twice: once at the entity level on corporate profits and again at the shareholder level on their dividends. Like LLCs, certain corporations can elect to be taxed as an S corporation to avoid this double taxation.

Partnerships

A partnership is a fairly simple business arrangement between two or more business partners. A limited partnership is one in which certain partners are not involved in the business’s day-to-day operations. By contrast, the partners in a general partnership all share the same responsibility and contribute to the business on a daily basis, including making business decisions on behalf of the business.

Partnerships are usually a good option for smaller businesses with just a few owners or groups of professionals who want to start a business together.

Still Unsure Which Business Entity to Choose?

Ultimately, speaking to our business formation attorneys will be the best way to determine the best entity type for your new business. This is because when it comes down to it, the answer to Which business entity should I choose? is “It depends.” Every business has different needs and goals.

We’re here to help you with your next business venture, so don’t hesitate to contact us with further questions about your options and the pros and cons of each. The SRNM business team can help you with forming an LLC, corporation, or other business entity and provide tax planning advice along the way.